BCOM, BBA, CPA AND ACCA, accounting students and Any Other Accounting Practitioners.

Understanding IAS 37-Provisions, Contingent Assets and Contingent Liabilities.

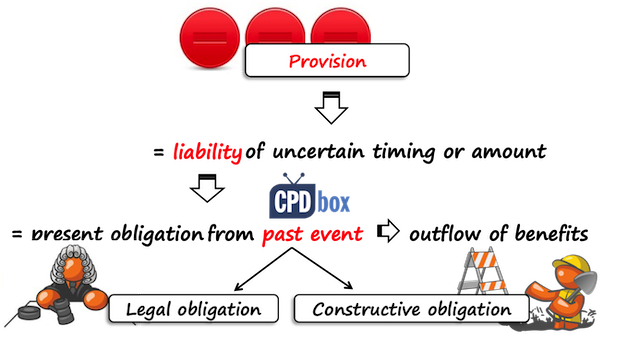

Provision

A provision is a liability of uncertain timing and amount.

The objective of IAS 37 is to specify the accounting treatment for provisions- This accounting standard brings about consistence in the making of provisions in the financial statements.

We recognize a provision if a reliable estimate can be made.

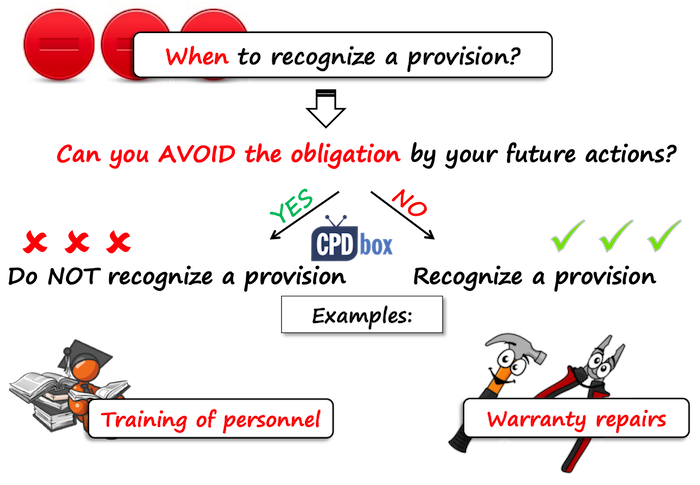

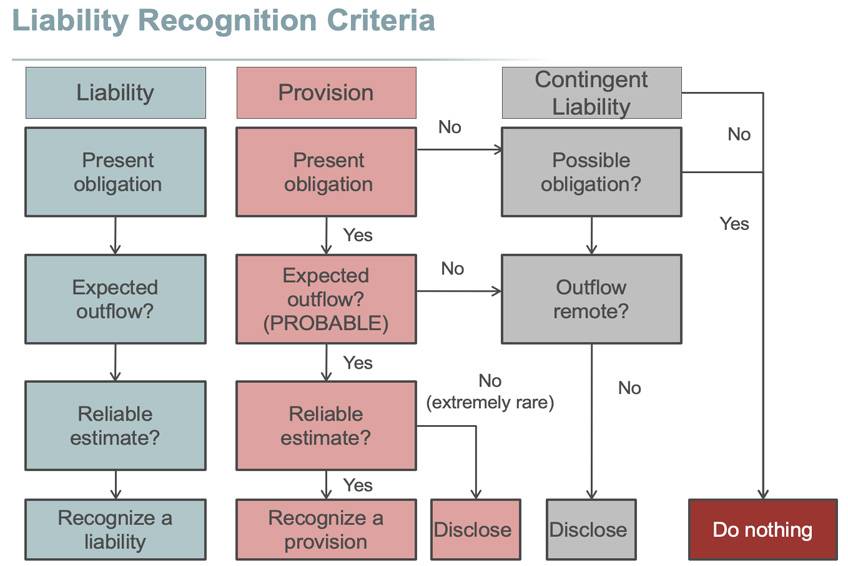

IAS 37 stipulates the recognition criteria in the financial statements for Provisions which is;

- There must be a present obligation as a result of past event and;

- It is probable that an outflow of economic benefits will be required to settle the obligation.

- A reliable estimate can be made.

When such conditions exist, the entries in the financial statements will be as follows;

Dr Expense when provision is created

Cr Provision (Liability).

Contigent Liabilities

These are not recognized in the Financial Statements hence no double entry is passed unless; there is information regarding the same then only disclosed in the notes to the financial statements.

Also read:https:https://www.campustimesug.com/?s=ifrs+5